You are reading Week 20 of 52 Weeks to Eliminate Debt & Curb Spending. Please read the overview here to learn more about the series & get your FREE financial planner. If you just joined us, please start with week 1.

If you have looked for any information in the past regarding getting out of debt, Dave Ramsey is a familiar name. One of the most popular methods he presents is using the envelope method to help stay on budget each month. This method is a great way to stop overspending. We are going to look at our version of the envelope method this week and hopefully inspire you to use it as well for future months budgeting. While the concept came from Mr. Ramsey, you should adapt it to suit your needs.

Using The Envelope Method:

The envelope method is recommended because it offers you a chance to see money as it disappears to pay bills. Once the set amount of money has been spent, you have no more to spend. Simple as that.

The envelope system is a great visual and budgeting tool.

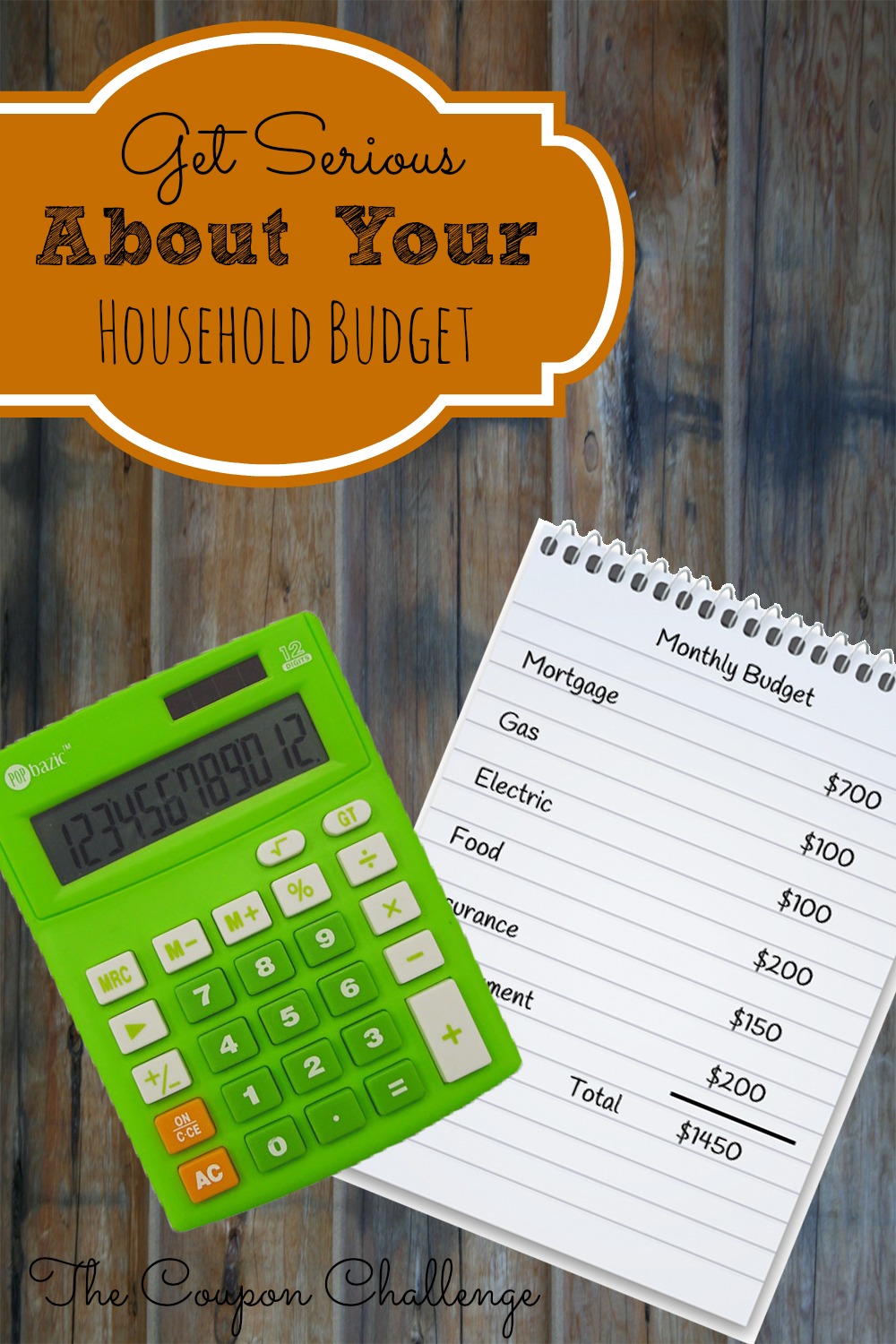

However, I am much more comfortable continuing to have my pay check direct deposited into my bank account, and scheduling bills to be paid directly from there. For things like your utilities, mortgage, insurance and vehicle payments continue to pay directly from your bank account. I recommend setting up bill pay with your bank so the check is sent directly from them. There is no fee and you know it will arrive on time every time. This step will help eliminate hidden fees as we discussed a couple of weeks ago.

Withdraw cash for groceries, gas and incidentals. At this point, stop by your bank and withdraw the monthly amount budgeted for groceries, gas and incidentals. These are some of the areas we tend to overspend quickly. This money should be there to cover everything from your grocery and household needs, to incidental splurges, lunches out, kids needs and gas.

Once the money has been spent, you have no more to spend until next month or the next payday. This gives you a visual and physical method of understanding how and when you are spending your money. You can put cash money into envelopes designated for each of these areas of purchase, or keep it together knowing it has to work for all of those.

Personally, I separate the amounts out into envelopes. It’s easier for me to track my spending this way. I have a separate envelope for each of my “extra” categories. If you looked at my envelopes you would see groceries, eating out, entertainment, Dana allowance, Derrick allowance, kids needs, house, and gifts.

When money is gone create a spending freeze. This is where the real savings begins. When you set your budget and can’t stick to it, do you typically just pull more money out of the bank to pay for things? Or perhaps you have been using credit cards to make up the difference? When you use the envelope method, the idea is to stop spending when money is gone. On top of that, you hope at the end of the month you’ll have leftover money in your envelope to put back into savings.

When you are out of money – you have to stop spending. No more groceries. No more gas. No more special lunches out, etc.

Another approach is to “roll” the cash from one month the next. This is helpful if you have a special event coming up. Maybe you and your spouse want a special dinner out that will cost more than your typical months budget. Save money prior to the event, so you can splurge debt free.

Every few months I would take out my leftover money and make a deposit into my savings account or into checking to pay off more deft.

If you find yourself going over the amount of cash you have each month. It’s time to reevaluate your budget and spending habits.

What you need:

The frugal method is to use standard letter sized #10 envelopes. You can simply write the category on your envelope or tape a spending record on each. I used this printable envelope label when I first started with the cash system. Recording my expenses forced me to keep track of where my money was going and allowed me to make adjustments based on my spending habits.

You will also need something to keep your envelopes together. Your cash envelopes will become your new wallet so to speak. I found this one as an example, but you can usually find them in the $1 Spot at Target.

If you prefer to get fancy, purchase Dave Ramsey’s Deluxe Executive Envelope System or a this pretty version of the envelope system.

Using the envelope method is a highly popular way to help you focus on where and how you are spending money. As a result, you often find yourself having a much easier time paying off debt. As you see your money physically leaving your possession you will be less likely to use it. Trust me – it worked for us!

Week 20 Challenge:

Give the envelope system a try. Create your envelopes and commit to only spending the amount of cash on hand.

Disclosure: I am not a financial adviser nor do I have formal financial training. All articles are for informational purposes only and should not be interpreted as financial advice or consultation. Please consult your account and/or financial adviser before making changes to your finances. All situations are different, so please consult a professional to determine your individual needs.