{Pin It}

UPDATE – Start off 2016 right! Don’t miss all the articles from my 52 week series. They are all on the blog already, so start reading and get ready to ELIMINATE DEBT!

Are you ready to get your budget under control? Do you long to live a life without debt? Then get ready for our new series: 52 Weeks to Eliminate Debt and Curb Spending!

Each week we will discuss practical ways to help you get out of debt and take back control of your finances. Now, this isn’t an easy challenge but it’s one that you must commit to in order to help secure your financial future.

Some of you may be thinking it’s not possible to be debt free. Maybe you’re living paycheck to paycheck and are just barely making your minimum payments each month. Regardless of your financial situation, you can still get out of debt.

For some people (depending on the amount of debt) it may take just a few months, but for others a few years. However long the road to a debt free life, it will be worth it in the end. Just stick to the plan.

My family is finally living debt free. Our goal was always to be debt free except for our mortgage. Once we wrote that last check, it was liberating. I felt like a weight had been lifted from my shoulders, and I want all of you to feel the joy of not owing your hard-earned money to someone else.

Are your ready to eliminate your debt? Get started with Day 1!

Week 1: Establishing Debt Relief Goals

Week 2: Make a Functional Family Budget

Week 3: Making a Debt Repayment Plan

Week 4: What Debt Should We Pay Off First?

Week 5: Finding Income When you Have None

Week 6: Change the way you view money

Week 7: 3 Ideas to Make the Step to Downsize

Week 8: Making Wise Budget Choices

Week 9: 8 Ideas for Finding Alternative Sources of Income NOW

Week 10: Is Bankruptcy Ever a Good Choice?

Week 11: How to Avoid Bankruptcy

Week 12: How to Negotiate with Creditors

Week 13: Get Rid of Money Zappers

Week 14: Green Living for Debt Relief

Week 15: Focus on Student Loan Debt

Week 16: Understanding How Your Spending Habits Affect Your Debt

Week 17: Why Do You Need a Savings Account?

Week 18: How to Find & Eliminate Hidden Fees

Week 19: Get Serious About Your Household Budget

Week 20: Get Started Using The Envelope Method for Debt Relief

Week 21: Evaluate Your Success And Make Changes

Week 22: Knowing When You Should Refinance Your Mortgage

Week 23: 7 Ways To Save Money On Groceries & Household Expenses

Week 24: Credit Card Settlement Facts – You Need to Know

Week 25: Are You Planning for Your Retirement?

Week 26: Cancel Unnecessary Subscriptions – Don’t Miss These 6 Memberships

Week 27: Downsizing Your Vehicles for Ultimate Savings

Week 28: How to Vacation for Free or Cheap

Week 29: Practical Ways to Teach Your Kids Healthy Money Habits

Week 30: Tips to Embrace a Simpler Lifestyle

Week 31: Saving On Education Expenses

Week 32: Gardening as Debt Relief

Week 33: Are Balance Transfers and Debt Consolidation Right for You?

Week 34: Creating Income With Yard Sales

Week 35: 5 Best Grocery Store Savings {Without Coupons}

Week 36: Tips for Negotiating Interest Rates On Credit Cards

Week 37: Focus On Long Term Debt Changes

Week 38: Ask For Outside Advice Regarding Your Debt

Week 39: Use Your Talents To Pay Off Debt {10 Work at Home Ideas}

Week 40: How to Plan a Weekly Menu {Money and Time Saving Tips}

Week 41: Don’t Pay For Something You Can Get For Free

Week 42: Change Your Bill Pay Method For Debt Relief

Week 43: Knowing When To Close Credit Accounts

Week 44: Tips For Going On A Spending Freeze

Week 45: Living Debt Free At Christmas

Week 46: Bartering To Pay Off Debt

Week 47: Let Interest Accounts Make Money For You

Week 48: Motivate Yourself To Change Financial Habits

Week 49: Set Long Term Financial Goals

Week 50: Is It Time to Cut the Cord? Saying Goodbye to Cable

Week 51: Don’t Fall Victim To The Debt Trap Again

Week 52: Focus On Debt Relief Success

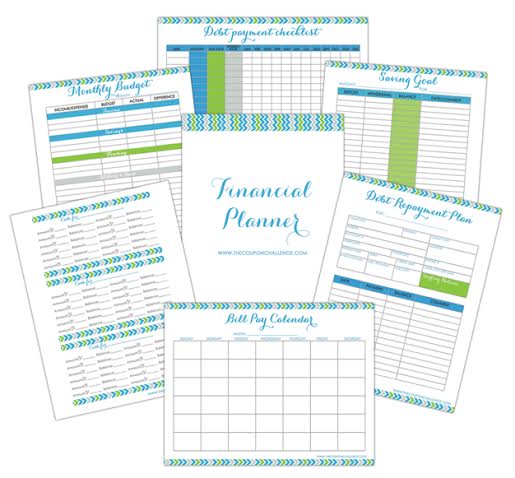

Don’t miss a week of the series. Get each weeks post straight to your inbox and get a FREE Financial Planner! The planner includes:

- Savings Goal Worksheet

- Debt Payment Checklist

- Debt Repayment Plan

- Bill Pay Calendar

- Monthly Budget Worksheet

- Cash Envelope Template

Sign up below or click HERE to get your FREE financial planner.

I’ve also created a Pinterest board that you can follow along as I pin each weeks post plus more ways to keep your budget on track and curb your spending.

Now let’s get started!

Disclosure: I am not a financial adviser nor do I have formal financial training. All articles are for informational purposes only and should not be interpreted as financial advice or consultation. Please consult your account and/or financial adviser before making changes to your finances. All situations are different, so please consult a professional to determine your individual needs.

[…] are reading Week 1 of 52 Weeks to Eliminate Debt & Curb Spending. Please read the overview here to learn more about the series & get your FREE financial […]